OWNERSHIP STRUCTURE

SABIC was established by the Government of Saudi Arabia as a 100% state-owned company. Its shares were listed on the Saudi Stock Exchange in 1984, at which time the Government divested 30% of its shareholding in SABIC. On March 27, 2019 (corresponding to 20 Rajab 1440H), the Public Investment Fund (PIF) and Saudi Aramco signed a share purchase agreement, pursuant to which Saudi Aramco agreed to acquire all of the Government stake in SABIC. The transaction was completed on June 16, 2020 (corresponding to 24 Shawwal 1441H). As of December 31, 2020, SABIC had issued and paid up share capital of SAR 30,000,000,000 consisting of 3,000,000,000 shares of SAR 10 Par value per share. The following entities hold more than 5% of SABIC-issued shares:

| Name |

|

No. of shares | Percentage of ownership |

|---|---|---|---|

| Aramco chemical company | 2,100,000,000 | 70% |

The remaining 30% SABIC shares are floated in the Saudi stock exchange and owned by other investors, including certain institutions and private investors. Certain shares are also held by SABIC's Board of Directors and Senior Executives. Other than the Aramco chemical company, SABIC is not aware of any shareholder that, directly or indirectly, owns or could exercise control over SABIC. In addition, SABIC has not been informed by persons (other than the Board, Senior Executives, and their relatives) who own SABIC shares, for their holdings, together with any change to such interests during 2020.

DESCRIPTION OF DIVIDEND POLICY

Dividend is subject to realized net income and free cash flow during the year and according to Article 41 of the Company bylaws, which reads as follows:

1. Annually, the Corporation shall set aside ten percent (10%) of the net profits to form the statutory reserve. The Ordinary General Meeting may decide to stop this deduction whenever the said reserve amounts to thirty percent (30%) of the capital of the Corporation. If in any year, the reserve falls below thirty percent (30%) of the capital, the Corporation shall again set aside until the reserve amounts to thirty percent (30%) of the capital. The Ordinary General Meeting has the authority to decide other kinds of reserves.

2. After deducting the statutory reserve and any other reserve that may be decided by the Ordinary General Meeting, five percent (5%) of the paid-up capital shall be distributed from the annual net profits of the Corporation to the shareholders as an initial dividend.

3.With due regard to the provisions of the Companies Law, the required amount shall be allocated for the Board members’ remunerations approved by the Ordinary General Meeting in compliance with Article 15 of this bylaws provided that entitlement for such remuneration shall be proportional to the number of sessions attended by the member and the member’s jurisdictions and responsibilities. Thereafter, the balance shall then be distributed to the shareholders as an additional dividend or carried over to the next years.

Note that the Board of Directors had approved 1st half dividend and recommended 2nd half to the General Assembly to distribute dividends for 2020 as follows:

| Dividends cycle |

|

Dividend per share | Percentage of distribution to share nominal value | No. of shares | Total distributed dividends | Date of eligibility | Date of eligibility |

|---|---|---|---|---|---|---|---|

| Second half of 2019 | SAR 2.2 | 22% | 3 billion | SAR 6.6 billion | 21st April 2020 | 12th May 2020 | |

| First half of 2020 | SAR 1.5 | 15% | 3 billion | SAR 4.5 billion | 3rd September 2020 | 20th September 2020 | |

| Second half of 2020 | SAR 1.5 | 15% | 3 billion | SAR 4.5 billion | The end of the second trading day of the day of the General Assembly of the company, which will be announced later. | Will be announced at the AGM invitation. |

SABIC IN CAPITAL MARKETS

SABIC SHARE PERFORMANCE

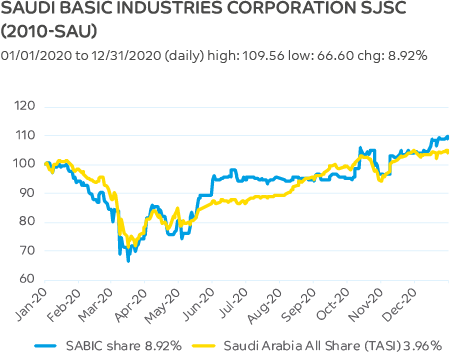

Despite the challenges brought about by COVID-19, SABIC shares gained 8.92% in 2020, outperforming the Tadawul All Shares Index (TASI), which was up 3.96%. With a market capitalization of SAR 304.2 bln or US$ $81.12 billion as on December 31, 2020, SABIC remained the biggest constituent of TASI with a weight 12.92%.

SABIC’s share price opened in 2020 at SAR 93.10 and it traded broadly in line with TASI, falling to the lowest level for the year on March 12, following the outbreak of COVID-19 outside China. Despite reaching lowest levels since early 2016, the share price recovered to the January 2020 levels early October and further rallied and passed the SAR 100 mark at the end of December for the first time since August 2019, reflecting sustained economic recovery, which translated into an improvement in earnings for SABIC.

SAUDI BASIC INDUSTRIES CORPORATION SJSC (2010-SAU)

SABIC DIVIDEND AND CAPITAL ALLOCATION

Our global business model and supply chain continued to be our key strengths. They provide a platform for growth and shareholder returns by generating a sustainable free cash flow throughout the cycle.

Distributing competitive dividends to our shareholders continues to be paramount, and this is supported by our firm commitment to maintaining capital discipline, as well as our ability to uphold a strong balance sheet and credit rating.

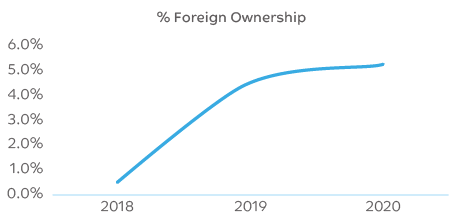

% Foreign Ownership

STRONG ENGAGEMENT WITH INVESTMENT COMMUNITY

Following the reclassification from Frontier Market to Emerging Market by several financial market indices starting mid-2018, the foreign ownership in Saudi companies has been consistently increasing. The year closed with 5.25% foreign ownership, with a mix of active, passive, and ESG funds as new investors.

We continue to have a world-class engagement with all participants of capital markets with continuous and open communications, including institutional, private investors, and analysts. As the pandemic enforced social distancing protocol continued throughout the year, the majority of the events turned virtual, bringing benefits, like increased participation in existing and new events, and also enabling us to reach out to several new investors.

To that effect, the Ordinary Annual General Meeting and Extraordinary General Meeting were held virtually in record time to allow all shareholders to participate and exercise e-voting – an action which represented an increased participation of +80% shareholders.

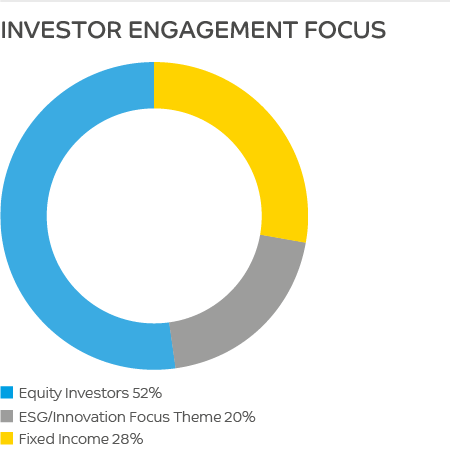

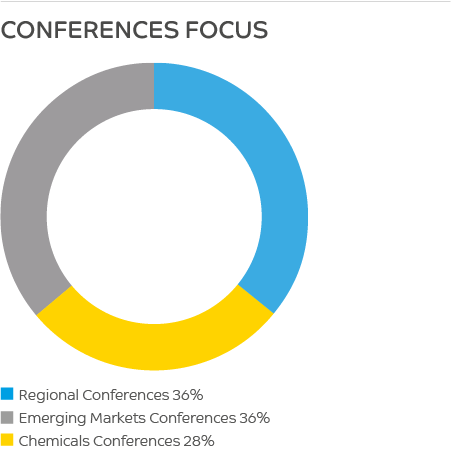

Over the course of the year, we held more than 130 meetings where we meet over 550 investors, participating in regional, emerging, and international chemicals conferences. In addition, with a rising investor interest in sustainability, we participated in conferences focusing on Environmental, Social, and Governance (ESG) issues.

INVESTOR ENGAGEMENTS FOCUS

Conference Focus

EARNINGS CALLS AND BEST-IN-CLASS DISCLOSURES

A step change event in 2020 in our world-class investor relations came with the going live of Earnings Calls for the Q4 2019 results. This coincided with one of the most challenging financial performances of the past years, but the SABIC management went ahead with the belief that transparency is paramount at both good and challenging times.

As part of enhancing disclosures, we started posting Earnings Release on Tadawul Stock Exchange, along with quarterly results starting from Q1 2019. This comprises explanations and full details of the quarterly results and outlook statements. The disclosures in the Earnings Release are best-in-class and similar to our top international peers.

It is 10 years since we published our first Sustainability Report. The sustainability report is posted on www.sabic.com/en/sustainability. It has substantially been evolving over the years to include broader Environmental, Social, and Governance (ESG) disclosures.

ESG disclosures have been embedded into the Earnings publications from the outset, acknowledging the need from investors to also understand the ESG performance and outlook.

We also merged the Annual report and the Board of Directors report for 2019 reporting within an integrated report. The Middle East Investor Relations Association (MEIRA) recognized it as the best 2020 Annual Report in Saudi Arabia and one of the best in the MENA region.

DEBT INVESTORS AND CREDIT RATINGS

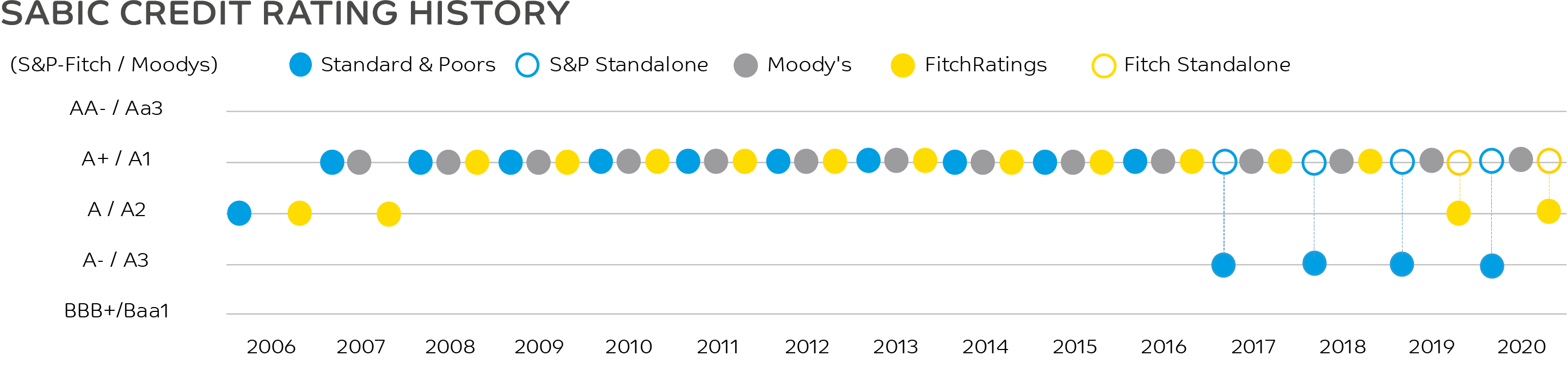

SABIC marketed a US$ 1 billion dual-tranche bond offering in September 2020, with a dual listing in Dublin and Taipei at 10 and 30 years respectively. The 30-year tranche represented a debut bond listing in the Taiwan stock exchange by a Saudi firm, effectively a “Formosa” Bond. This issuance demonstrated SABIC’s agility and robustness to adverse market conditions, and its attractiveness for a diverse investor base looking for different tenors, which stimulated demand and drove favorable prices, reflecting continued financial strength supported by a strong balance sheet and solid credit rating.

Our standalone credit ratings have been consistently on the A+/A1 band, among the highest-rated global chemical companies, demonstrating consistent resilience over the last decade versus some of our peers.

Sabic Credit Rating History

ESG AT SABIC

We are determined to integrate ESG factors and disclosures into our core business strategy and processes and make them part of our DNA. This year, we formed a cross-functional and regional ESG Reporting Steering Committee to support the organization on the ESG reporting integration journey and mobilize employees to implement their strategies and roadmaps.

Two ESG targets were announced in the Q4 2020 earnings call for 2021:

- We are evaluating at all levels of the organization to be able to commit to the “Science-Based Targets” (SBTs) during 2021, an initiative, which aims to achieve carbon emissions reduction.

- As we continue to drive excellence in environmental performance, we aim to expand our ESG-linked incentives to the leadership contributing to our Energy Efficiency and Carbon Management realization targets.

We have been participating in CDPs program to report on climate disclosures since 2013. We retained “B” score in 2020, which is one of the best scores in the Middle East and at par with the chemical sector average. Last year, we also joined the CDP Supply Chain Program to help suppliers disclose their own emissions.

We also have a BBB rating by MSCI, which is placing us in several MSCI ESG financial indices. Analysts highlighted, “SABIC has strong strategies to reduce carbon emissions, water use, and waste in its operations with ISO14001 certification for most sites”.

NUMBER OF THE COMPANY’S APPLICATIONS FOR THE REGISTER OF SHAREHOLDERS AND THE DATES AND RATIONAL OF SUCH APPLICATIONS

| No. |

|

Application date | Application rational |

|---|---|---|---|

| 1 | 20 April 2020 | AGM | |

| 2 | 20 April 2020 | Dividend Entitlement | |

| 3 | 31 May 2020 | Shareholder Data Analysis | |

| 4 | 10 June 2020 | EGM | |

| 5 | 16 June 2020 | Shareholder Data Analysis | |

| 6 | 16 June 2020 | Shareholder Data Analysis | |

| 7 | 16 June 2020 | Shareholder Data Analysis | |

| 8 | 16 June 2020 | Shareholder Data Analysis | |

| 9 | 16 June 2020 | Shareholder Data Analysis | |

| 10 | 06 July 2020 | Shareholder Data Analysis | |

| 11 | 06 July 2020 | Shareholder Data Analysis | |

| 12 | 07 July 2020 | Shareholder Data Analysis | |

| 13 | 08 July 2020 | Shareholder Data Analysis | |

| 14 | 08 July 2020 | Shareholder Data Analysis | |

| 15 | 19 July 2020 | Shareholder Data Analysis | |

| 16 | 07 September 2020 | Dividend Entitlement |