ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

The elements of a substantial ESG approach have been part of SABIC from the outset: diligent and farsighted corporate governance; a sense of responsibility and care toward our wider stakeholders and society; and a commitment to environmental stewardship. Set alongside an ambitious agenda for business growth towards becoming the preferred world leader in chemicals, these elements collectively represent the complex vision of sustainability that drives our Company.

SUSTAINABILITY STRATEGY DRIVEN BY TRANSPARENCY

Several motivating factors propel our desire to integrate ESG into our long-term strategies and business practices, including addressing the needs of our diverse stakeholders, keeping pace with changing regulations, building our sustainable portfolio, and enabling responsible long-term growth for SABIC. We took initial steps toward telling our early ESG story in a systematic way with the publication of our first Sustainability Report in 2011. Since then, we have continued our ESG reporting journey through refining our stakeholder engagements, materiality analyses, and risk and opportunity assessments; setting targets and tracking KPIs that reflect evolving global standards; and increasing the transparency of our corporate reporting.

Following a major sustainability materiality assessment in 2018, we identified six sustainability materiality areas, and aligned them with 10 of the 17 UN Sustainable Development Goals (SDGs), addressing issues such as poverty, climate change, environmental degradation, and prosperity. In 2021, we further aligned our strategy and operations with universal principles on human rights, the environment, labor, and anticorruption.

We act on and operationalize our six sustainability materiality areas – resource efficiency; climate change and energy; innovation and sustainability solutions; circular economy; governance and ethics; and EHSS – through four domains: climate change, circular economy, safer chemistry, and ESG disclosures. This year, we initiated a refresh of our materiality analysis, which will help provide clarity and alignment for SABIC as we progress on our sustainability goals.

In particular, the domain of ESG disclosures is aimed at ensuring increased transparency in the other three domains. At the heart of our disclosure journey is an understanding that financial data only tell part of SABIC’s story. ESG factors are often referred to as ‘non-financial’; yet how we manage them undoubtedly has tangible and measurable financial consequences―and, beyond that, consequences for the resilience of our business model and our ability to create value over the short, medium, and long term.

SABIC has shown considerable improvements in its ESG disclosure scores in recent years, with social and governance scores mostly contributing to these improvements; thus, we recognize a need to focus more on our environmental disclosure scores. The full narrative on our material sustainability areas, along with detailed disclosures, is presented in our Sustainability Report 2022. A concise perspective on this story―examined through the multi-capital lens of integrated reporting―is provided in the chapters on Corporate Performance that follow.

EVOLVING REPORTING LANDSCAPE

ESG disclosures, by their very essence, are about presenting information that is consistent, comparable, and meaningful to a diverse audience. Collaborating with a variety of organizations involved with disclosure guidance and standards, therefore, is imperative. We are working with the World Economic Forum (WEF) framework on Stakeholder Capitalism to orient SABIC’s purpose toward creating long-term value not only for shareholders but also our broader stakeholders. We are active members of the WEF ESG practitioners’ group and we consider WEF metrics good guidance for enhancing the standardization and value orientation of the ESG disclosures. This year, we were featured in the 2022 WEF “Stakeholder Capitalism Metrics Initiative: Partner Case Studies” white paper as one of the 150 companies globally to have adopted ESG metrics that drive internal corporate transformation for sustainable reporting.

We are also actively engaged with CDP (formerly Carbon Disclosure Project) and earned a C rating from CDP water for 2022; the World Business Council for Sustainable Development, where we joined the CFO network this year; EcoVadis; Ethisphere Institute; and the Global Reporting Initiative - all of which provide us valuable guidance on our ESG disclosure journey. In recognition of our commitment to adopting the highest ESG standards, we garnered the “Best ESG” award at the Saudi Capital Market Awards 2022 in March of this year.

We applaud the International Financial Reporting Standards (IFRS) Foundation for its move to create the International Sustainability Standards Board (ISSB) and taking the lead in setting up rigorous processes for robust comparable standards for global companies. We continued contributing to the open consultations on ISSB, providing both support for its formation and in calling for fair representation of developing countries. We look forward to the possible publication of these standards in 2023, which will be transformative in terms of building cohesion and alignment in the corporate reporting landscape.

We also welcome the release of the GRI Universal Standards 2021, effective for reports published after January 1, 2023. The new standards provide greater clarity on concepts, materiality, and reporting principles, helping the organization navigate disclosure requirements in response to recent developments. Again, the trend is clear and important: a move towards greater simplicity, usability, data quality and consistency of application in disclosures, which in turn will promote corporate reporting that is more relevant, meaningful, and comparable across businesses, sectors, and regions.

CRUCIAL ROLE FOR CORPORATE GOVERNANCE

We are constantly looking to deepen the integration of ESG factors into our core business strategy and weave enhanced disclosures into the very fabric of our processes, tools, and priorities, whether regulation demands it or not. By doing so, we embed ESG into decision-making at every level and in every area of the organization and create a culture where everyone at SABIC shares a common understanding of the megatrends that will affect our company and society over the decades ahead. In this regard, direction and involvement from governance is crucial.

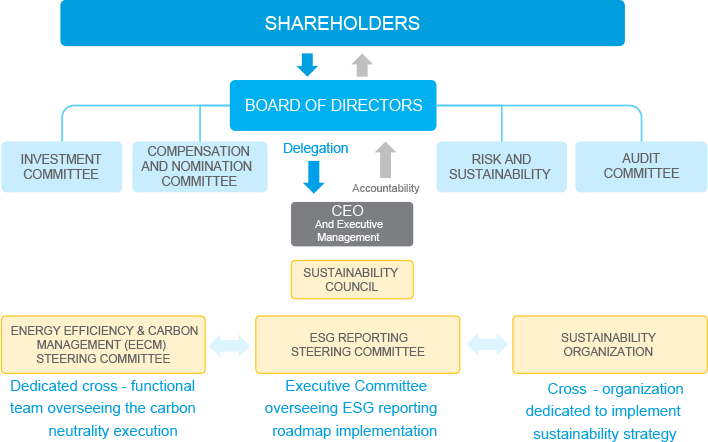

SUSTAINABILITY GOVERNANCE STRUCTURE

To this end, SABIC has established the ESG Reporting Steering Committee. The Committee’s primary task is to formulate and drive SABIC's ESG reporting strategy and roadmap and promote the integration of ESG factors into core business processes and decisions. Headed by both our CFO and CTO/CSO, the ESG Reporting Steering Committee is responsible for:

– Understanding ESG performance and identifying the most relevant ESG disclosures for the company.

– Identifying and proposing general ESG reporting frameworks, and prioritizing current and emerging ESG issues that may affect operations.

– Establishing a clear and well-defined ESG reporting charter for the organization, along with a roadmap for its fulfillment, by capturing the ESG reporting priorities from the businesses and functions.

– Serving as a strong platform to engage and enhance SABIC’s understanding of ESG matters.

– Supporting the evaluation of ESG risks and opportunities and seeking ways to monetize them.

As ESG reporting and focus on the company gains external attention, we recognized that the existing setup of the ESG Reporting Steering Committee required restructuring. In 2022, accordingly, we expanded membership to add members from businesses and functions to the Steering Committee.

We also created a dedicated Project Management Office (PMO) to develop ESG processes that address critical areas and build capabilities. As complement to this internal focus, we expanded the ESG Reporting Practitioners Group to strengthen our communications across functions and regions as well as with our stakeholders.

Our ultimate goal is to bring non-financial disclosures to the same standard as financial disclosures in terms of accuracy, transparency, consistency, and comparability as we transition to an Integrated Report within the next two years.