SABIC’s vision is to be the preferred world leader in chemicals. To realize this vision, our strategy lays out a roadmap to transform SABIC into a higher growth, sustainability-driven, more resilient, and more agile chemical company while playing a key role in Saudi Vision 2030.

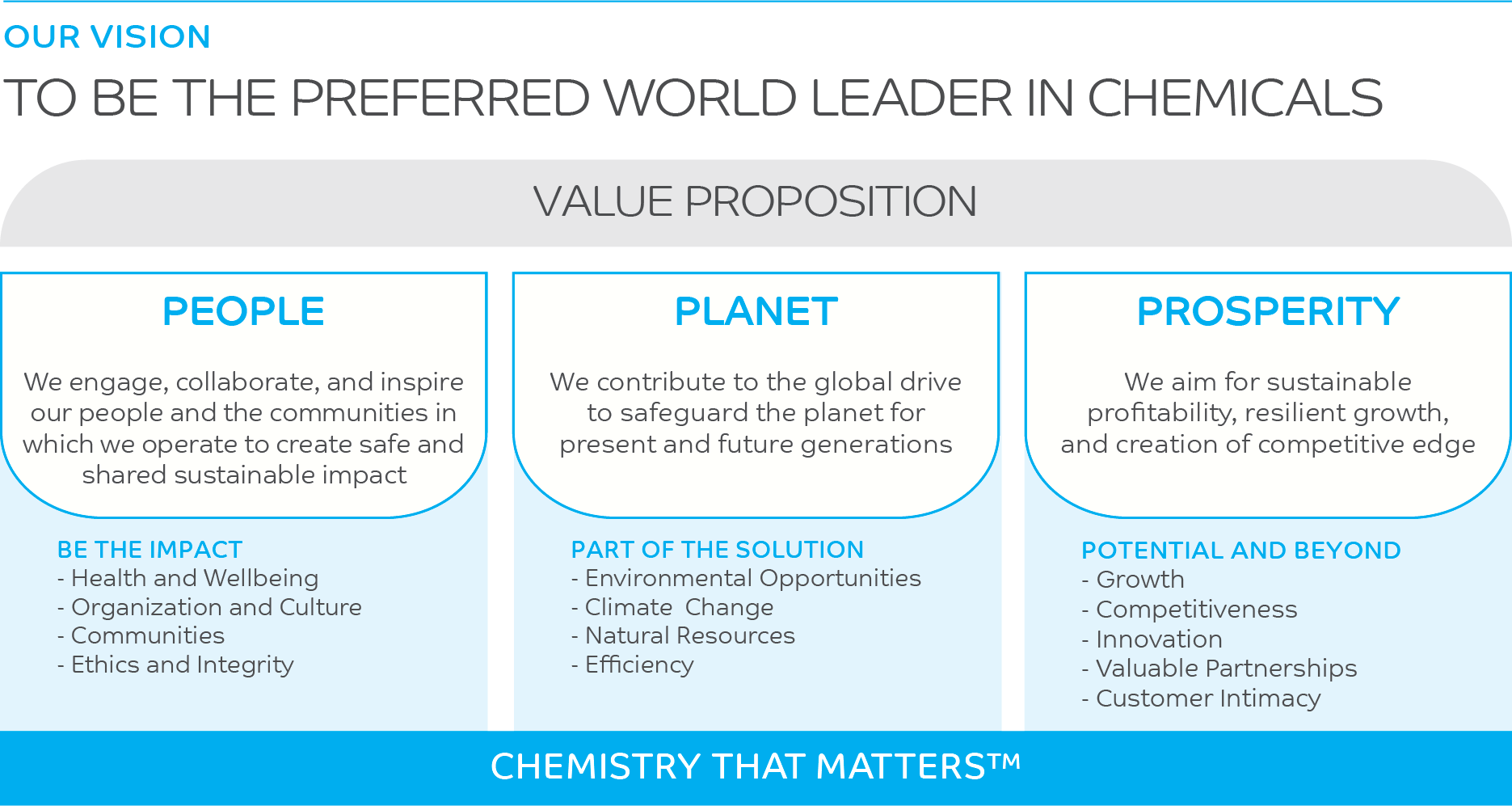

In our Annual Report 2021, we updated our value proposition map, which had been a staple of our corporate reporting since 2019. The primary elements of our strategy remain the same; however, our new mapping allows us to more accurately represent and report on the broad value proposition that we offer our shareholders and stakeholders, which is the primary aim of this Annual Report.

We have chosen to visualize our strategy around the three fundamental pillars of the Triple Bottom Line (TBL) approach: People, Planet, and Prosperity. Our mapping of these three pillars accords them equal priority within this model. It represents our commitment to thinking about the future of our business together with the future of our society and planet, and to respond with solutions that have the pace and scale to address the challenges of our contemporary world.

At the heart of our enterprise is the pursuit of strong, profitable, and sustainable business growth and value creation for our broad stakeholder base, including shareholders, customers, employees, regulators, suppliers, and local communities. We will continue to target world-class financial performance by: working hard to understand the evolving needs of our customers in terms of service, product differentiation, and solutions; accelerating growth both organically and non-organically by being close to regional markets; striving for a competitive advantage selectively through process, catalyst and application development; and improving efficiencies in our core areas of manufacturing, commercial, supply chain, and cost management.

We will contribute to the global drive to safeguard the planet for present and future generations by responding to the profound effects of climate change along with recognizing the equally profound opportunity for businesses to spearhead change. We remain committed to decarbonizing our operations by 2050 and reducing our absolute greenhouse gas emissions by 30% by 2030 to support our Carbon Neutrality pledge.

We will engage and collaborate with our stakeholders with an understanding that we have a responsibility to the communities in which we operate. We will ensure long-term success via an effective and efficient organization, a robust and consistent performance culture, investments in leadership and training, and a strong set of values around inclusiveness, diversity, and integrity. We will maintain our unshakeable emphasis on process safety and product stewardship.

GROWTH IN CONTEXT

We have identified five facets that will anchor and drive our business performance in the years ahead and help shape our decisions and investments: robust financials with a strong balance sheet; decisive and focused execution of our growth strategy; diversified global market and customer relationships; our role as the national chemicals champion; and an overarching emphasis on innovation and sustainability.

But this emphasis on growth must be placed in the context of a rapidly changing operating environment. We recognize that SABIC’s ability to create value year after year equally requires a more comprehensive approach in assessing impact and success – one that takes into account the wider societal and environmental megatrends that affect and are affected by our business. We have identified three longer-term megatrends that deserve our attention:

- Shifting Globalization: The industrial transformation in China coupled with reglobalization shakeups will impact regional and market scale and scope.

- Intervening Policy: The growing importance of sustainability and energy transition will impact the way we do business.

- Disruptive Technologies: Innovations in digitalization and new mobility constitute irresistible forces that will transform value chains.

Having assessed the seriousness of these implications, we expect and are preparing for seismic shifts in the energy value chain along with new regional positions in economies and markets.

We progress on our strategy through a clear list of yearly priorities and deliverables. This clarity allows us to focus on our long-term vision while contending with current short-term challenges such as: inflation and monetary tightening; slowing economic growth; volatile oil and gas prices; lower demand prices; and decreasing margins. Despite these obstacles, we remain on track as we transition to the next chapter in our evolution, ushering in a new wave of growth that brings us closer to markets and feed-stocks and increasing our flexibility and competitiveness.

In 2022, our key priorities revolved around five major aspects:

- Strategy: Driving profitable growth while continuing to deliver on synergy benefits with Saudi Aramco.

- Accelerate Sustainability & Innovation: Placing increasing importance on Carbon Neutrality, Circular commitments, and ESG reporting.

- Financial Excellence: Maintaining stable to growing dividends and a strong standalone credit rating.

- Operational Resilience: Advancing competitiveness and strengthening the operating model.

- Future of Work: Prioritizing employee well-being and developing a winning & agile culture.

BUSINESS PORTFOLIO

In 2015, we launched a robust transformation program to further streamline our operating model, increase portfolio focus, boost competitiveness, and accelerate long-term growth. At the center of this transformation was moving from six Business Units to the three Strategic Business Units we have today: Petrochemicals, Agri-Nutrients, and Specialties. 2020 and 2021 were key years in this journey marking the realization of our current structure and positioning the three SBUs as autonomous entities with the ability to operate in their markets as global leading companies.

PETROCHEMICALS

SABIC’s Petrochemicals SBU strategy aims to enhance our leadership position by expanding our presence in fast-growing and emerging regions. We provide products and solutions with a customer-focused mindset, leveraging technology, innovation, and sustainability to address a range of end-user markets that include automotive, building and construction, healthcare and personal hygiene, packaging, and consumer and household goods.

With Saudi Aramco’s acquisition of a 70% stake in our company in June 2020, SABIC is now positioned as Saudi Aramco’s chemicals arm, allowing us to deliver on our agenda as the national chemicals champion and a leader in the global chemical industry. Our joint efforts with Saudi Aramco in petrochemicals have already been strengthened by leveraging our strong customer and market positions and attractive product portfolio to address the growth markets of China, India, South East Asia, and North America. These markets will be served through a range of feed-stock asset platforms and associated investment models. These growth platforms will be located mainly in Asia, Saudi Arabia, and North America and will be enabled by a combination of competitive advantages derived from both Saudi Aramco and SABIC, including advantaged and liquid feed-stock, refinery petrochemical integration, advanced technology, such as our crude-oil-to-chemicals project, and strong strategic partners where relevant.

There is growing pressure on the industry to take substantial action on plastic waste, to utilize waste as a feedstock, and to take meaningful steps to reduce the greenhouse gases released in manufacturing processes. In the coming years, we anticipate that sustainability will be even more centrally emphasized in our strategic direction, and we will develop our vision of balancing business growth with the move towards carbon neutrality and a circular economy.

AGRI-NUTRIENTS

In 2020, we initiated the integration of our agrinutrients assets under one umbrella with the intent to consolidate all related equity shares in a new company, the SABIC Agri-Nutrients Company. In 2021, SABIC and SABIC Agri-Nutrients Company worked with the clear vision of establishing the latter as an autonomous entity, bringing the core functions of the agri-nutrients business within its purview. The new company was officially launched on January 1, 2022.

This transformational initiative allows for more focus, resilience, and agility in SABIC’s agri-nutrient business. The new company functions with a distinct operating model that prioritizes sustainable growth and more diversified agrinutrients solutions through an emphasis on research and development programs, sales and supply chains, and talent attraction. SABIC is already a world-class producer and marketer of nitrogen and phosphates; the task now is to develop additional growth opportunities beyond commodity nitrogen fertilizers across the value chain. Our emphasis on research and development capabilities will also enable us to build a diverse portfolio of high-tech enhanced efficiency fertilizers and become a pioneer in the low carbon ammonia market.

SPECIALTIES

The Specialties SBU handles the manufacturing, distribution and sale of specialty plastics, and is a non-cyclical technology business that is not dependent on advantaged feed-stock. We address complex and unique customer needs through differentiation, sustainability, and speed to market.

Established as a fully independent and standalone entity in November 2020, the Specialties SBU is able to realize untapped growth potential, add value through increased agility and focus, and meet its specific business model and customer requirements. Positioned for sustainable and profitable growth, the Specialties SBU aims to become one of the top players in the “Multi-Segment Premium” specialty chemicals segment and provide innovative solutions that address the challenges our customers face. Critical to achieving our growth is increased customer intimacy and cross-functional engagement in each region we operate in. We see Specialties as being well positioned to experience growth via its continued investments into the exabyte, wellbeing, net zero, and circular economy, with market values running into estimations of trillions. Our innovative portfolio of solutions is aligned with transformational trends and, moreover, our global presence and close relationships with Original Equipment Manufacturers (OEMs) mean that we offer a strong geographical competitive advantage over competitors who are generally regionally focused.

HADEED (METALS)

Hadeed is a fully independent entity with a strategic vision to be the preferred local and regional leader in the steel industry. It produces steel for local and regional markets under two main streams of diversified long and flat steel. Hadeed’s principal focus is on growing its profitability through controlling costs and boosting reliability. Simultaneously, Hadeed is progressing on its sustainability goals by working to meet Saudi Energy Efficiency Committee (SEEC) targets - having lowered GHG, Energy, Water and Waste intensity by 9%, 4%, 7% and 9%, respectively, compared to last year - and it has developed a roadmap that is aligned with SABIC’s 2050 carbon neutrality aspirations. Hadeed also aims to continue supporting Saudi Arabia’s Shareek program to drive new investments and strengthen public-private relationships.

We believe that collaborating with partners, both domestic and abroad, is integral to our plans for growth.

CREATING SHARED VALUE WITH SAUDI ARAMCO

After Saudi Aramco acquired a 70% majority stake in SABIC in June 2020, both entities have strived to deliver on synergy benefits that generate maximum value. We expect SABIC’s share in the value creation and synergy to amount to a recurring annual value of US$ 1.5 billion to US$ 1.8 billion, which SABIC expects to achieve by 2025. SABIC is on track to reaching this goal: since 2020, SABIC has achieved a synergy value ~US$ 1.1 Billion, with a synergy value of US$ 735 million realized in 2022

The integration of Aramco and SABIC gathered steam with several key initiatives during the year. SABIC reached a major milestone in taking over the marketing and sales of several Aramco products, Polyolefins, Polyurethanes, Performance Monomers, Ethylene Oxide Derivatives, and Glycols - to better target downstream demand.

SABIC marketed chemicals and polymers from Aramco JVs, supplying our customers in China, South East Asia, Middle East and Europe with an enhanced product offering. It also successfully added new products to its portfolio such as Polyurethanes.

We also made considerable progress on hydrocarbon optimization between refineries and our steam crackers in Saudi Arabia.

GROWTH PROJECTS

The rapidly evolving landscape requires SABIC to extract the maximum value of its experience, networks, and capital to innovate for the future. In this endeavor, SABIC aims to increase its collaborations and partnerships to develop projects and products that enable sustainability, create synergy, and reinforce our brand. Our growth projects aim to position us for growth in sales volumes and profits while allowing us to progress on our carbon neutrality and circular economy goals.

Important first steps were made with two projects in collaboration with Sinopec (China Petroleum & Chemical Corporation). Pre-commissioning activities commenced at a polycarbonate production complex in China, developed by Sinopec Sabic Tianjin Petrochemical Company (SSTPC), as part of a joint venture between SABIC and Sinopec. The project is expected to produce 260,000 metric tons. Furthermore, SABIC signed an MoU with Aramco and Sinopec to conduct an economic and technical feasibility study on developing an integrated petrochemical complex with existing refineries in Yanbu, Saudi Arabia. SABIC also signed a joint development agreement with Aramco and PKN Orlen to assess the technical and economic feasibility of setting up a petrochemical production project in Poland, expanding our brand in the European market.

During 2022, SABIC signed multiple licensing and engineering agreements to develop process design packages (PDPs) for a world-class mega petrochemical complex in China.

SABIC intends to study the establishment of a complex to convert oil and liquids into petrochemicals in Ras Al-Khair in Saudi Arabia; the complex is expected to convert 400,000 barrels of oil into chemicals daily. The project will contribute to the realization of Saudi Arabia’s program to convert oil and liquid hydrocarbons into chemicals that offer cost efficiencies on a large scale and open value creation opportunities for the energy and chemical industry.

We believe that collaborating with partners, both domestic and abroad, is integral to our plans for growth. To this end, SABIC, OQ, and Kuwait Petroleum International (KPI) signed a joint Project Development Agreement to study the establishment of a jointly-owned petrochemical complex situated in the Special Economic Zone at Duqm (SEZAD), the Sultanate of Oman. The complex will consist of a steam cracker, derivative units, and a natural gas liquid (NGL) extraction facility.