OWNERSHIP STRUCTURE

SABIC was established by the Government of Saudi Arabia as a 100% state-owned company. SABIC's shares were listed on the Saudi Stock Exchange in 1984, at which time the Government divested 30% of its shareholding in SABIC. On March 27, 2019 (corresponding to 20 Rajab 1440H), the Public Investment Fund (PIF) and Saudi Aramco signed a share purchase agreement, pursuant to which Saudi Aramco acquired all of the Government stake in SABIC. The transaction was completed on June 16, 2020 (corresponding to 24 Shawwal 1441H).

As of 31 December 2021, SABIC had issued and paid up share capital of SAR 30,000,000,000 consisting of 3,000,000,000 shares of SAR 10 Par value per share. The following entities hold more than 5% of SABIC's issued shares:

| Name |

|

No. of shares | Percentage of ownership |

|---|---|---|---|

| Aramco chemical company | 2,100,000,000 | 70% |

NUMBER OF THE COMPANY'S APPLICATIONS FOR THE REGISTER OF SHAREHOLDERS AND THE DATES AND RATIONAL OF SUCH APPLICATIONS

| No. |

|

Application Date | Application Rational |

|---|---|---|---|

| 1 | January 4, 2022 | Shareholder Data Analysis | |

| 2 | April 10, 2022 | AGM | |

| 3 | April 12, 2022 | Dividend Entitlement | |

| 4 | May 25, 2022 | Shareholder Data Analysis | |

| 5 | May 31, 2022 | Shareholder Data Analysis | |

| 6 | June 1, 2022 | Shareholder Data Analysis | |

| 7 | June 2, 2022 | Shareholder Data Analysis | |

| 8 | August 17, 2022 | Shareholder Data Analysis | |

| 9 | September 13, 2022 | Dividents Entitlement |

The remaining SABIC shares are floating in the Saudi Stock Exchange and owned by other investors, including certain institutions and private investors. Certain shares are also held by SABIC's Board of Directors and Senior Executives. Other than the Aramco Chemical Company and General Organization for Social Insurance, SABIC is not aware of any shareholder that, directly or indirectly, owns or could exercise control over SABIC. In addition. SABIC has not been informed by persons (other than the Board, Senior Executives and their relatives) who owns SABIC shares, for their holdings, together with any change to such interests during 2022

DESCRIPTION OF DIVIDEND POLICY

Dividend is subject to realized net income and free cash flow during the year and according to Article (42) of the Company Bylaws, which reads as follows:

A. Annually, the Corporation shall set aside ten percent (10%) of the net profits to form the statutory reserve. The Ordinary General Assembly may decide to stop such set-aside whenever the said reserve amounts to thirty percent (30%) of the capital of the Corporation. If in any year, the reserve falls below thirty percent (30%) of the capital, the Corporation shall again set aside until the reserve amounts to thirty percent (30%) of the capital. The Ordinary General Assembly has the authority to decide other kinds of reserves.

B. After deducting the statutory reserve and any other reserve that may be decided by the Ordinary General Assembly, an amount representing no less than five 5% of Corporation’s paid up capital shall be distributed from the annual net profits of the Corporation.

The Corporation may distribute interim profits to its shareholder on half year or quarterly basis, in accordance with the regulations issued by the CMA.

The Board of Directors has decided to distribute cash dividends to shareholders for 2022 as follows:

| Dividends cycle |

|

Dividend per share | Percentage of distribution to share nominal value | No. of shares | Total distributed dividends | Date of eligibility | Distribution date |

|---|---|---|---|---|---|---|---|

| Second half of 2021 | SAR 2.25 | 22.5% | 3 billion | SAR 6.75 billion | 10th April 2022 | 25th April 2022 | |

| First half of 2022 | SAR 2.25 | 22.5% | 3 billion | SAR 6.75 billion | 11th September 2022 | 2nd October 2022 | |

| Second half of 2022 | SAR 2 | 20% | 3 billion | SAR 6 billion | 13th march 2023 | 2nd April 2023 |

SABIC IN CAPITAL MARKETS

We went public in 1984 by being listed in the Saudi Stock Exchange. At that time, the shareholder base was restricted to Saudi Arabia and other citizens in the Gulf Cooperation Council countries.

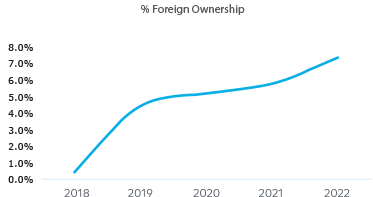

In recent years, international investment into Saudi Arabia has risen significantly. 2018 marked a major turning point for the nation as it continued its advancement and drive toward Saudi Vision 2030: global financial market indices reclassified the nation from Frontier Market to Emerging Market.

This was accompanied by a wave of interest from the international investment community toward listed companies on the Saudi Stock Exchange, including SABIC.

From having a foreign investor base well below 1% in 2018, the year closed nearly around 7.4% foreign ownership, with a mix of active and passive funds.

SABIC SHARE PERFORMANCE

Despite a very strong start of the year, reaching a record high of 139 SAR on 7 March, SABIC shares lost 22.9% during 2022 (14.4% gain in 2021). This compares with a performance of -7.1% on the Tadawul All Shares Index (TASI) and the -8.8% of the Dow Jones Industrial Average (DJIA) index.

With a market capitalization of SR 268.2 bln or USD$71.5bln at 31 December 2022, SABIC weights 2.72% of TASI. SABIC accounts for 38.82% of the market capitalization of all the Saudi-listed companies within the Materials sector.

SABIC’s stock was also the fourth most actively traded stock during the year in terms of value, with SAR 66.67 billion (US$ 25.23 billion).

SABIC’s share price opened the year at SAR 116.00 and it traded broadly in line with TASI until the beginning of April. The first half of the year was characterized by a strong demand and certain pricing power that uphold our prices to cover for increased inflationary cost.

The remaining of the year reflected the decline in demand and in our prices and the expectation of moderation of margins and outlook. Our share price at the end of the year closed at SAR 89.40. The combination of high energy cost, inflationary headwinds and weak markets has threaten our margins and profitability. As we look now to 2023, the business and market conditions remain very tough and uncertain.

| Five-year overview and dividend |

|

2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| Number of registered shares issued (M) | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | |

| Number of registered shares eligible for dividend (M) | 3,000 | 3,000 | 3,000 | 3,000 | 3,000 | |

| Share Price at the end of the year (SAR) | 116.2 | 93.3 | 101.4 | 116.0 | 89.4 | |

| High of the year (SAR) | 130.4 | 127.4 | 101.8 | 135.2 | 139.0 | |

| Low of the year (SAR) | 101.0 | 86.3 | 62.0 | 98.7 | 79.9 | |

| Annualized volatility | 20.4% | 20.3% | 34.2% | 20.5% | 23.2% | |

| Market capitalization at year-end (SARMM) | 348.6 | 281.7 | 304.2 | 348.0 | 268.2% | |

| Market capitalization at year-end (USDMM) | 93.0 | 75.1 | 81.1 | 92.8 | 71.5 | |

| Distribution per share (SAR) | 4.4 | 4.4 | 3 | 4 | 4.25 |

SABIC DIVIDEND AND CAPITAL ALLOCATION

Our financial performance was very strong during the first half of 2022 and has been impacted by the downtrend of the economy of the world, mostly driven by the energy prices.

Our global business model, supply chain and focus on asset reliability, continued to be our key strengths during last year. This provides a platform for growth and shareholder returns by generating a sustainable free cash flow throughout the cycle.

There was also a strong focus on capital discipline similar to 2021, which helped to support higher dividends and position SABIC well for future growth opportunities.

Distributing competitive dividends to our shareholders remained a key priority for SABIC in 2022. We declared cash dividends of SAR 4.25 per share to shareholders in 2022. This was 6.25% higher than the previous year.

SABIC’s capital allocation framework endorsed by our Board is to prioritize our adjusted Free cash flow 1) To support a stable to growing dividend and 2) To Fund Strategic Growth,…while ensuring we maintain a Strong Balance Sheet at all times.

This framework enforces strong capital discipline.

BEST INVESTOR RELATIONS PROGRAM IN 2022

We were hounoured with the Best Investor Relations Program Award 2022 at the Saudi Capital Market Forum, demonstrating the company’s continued focus on building a best in class IR organization and our strong commitment to meet the Capital Market Authority’s disclosure requirements.

STRONG ENGAGEMENT WITH INVESTMENT COMMUNITY

We continue to have a world-class engagement with all participants of the capital markets with continuous and open communications, including institutional, retail investors and analysts. The pandemic continued to enforce social distance mostly throughout the first half of the year, especially on international traveling, keeping the majority of the events virtual.

To that effect, the Ordinary Annual General Meeting was held virtual for the third consecutive year to allow all shareholders to participate and exercise e-voting, an action that proved very successful with 82.23% shareholder participation.

Over the course of the year, we held more than 40 engagements reaching over 800 investors and analysts, while participating in regional, emerging and international chemicals conferences.

In addition to the continuous dialogue with socially responsible investors, we participated and supported several ESG focused webinars, round tables and conferences, some of which are listed below:

– FII Regional Summit: Inclusive ESG For Emerging Markets

– Euromoney Sustainable Capital Markets Forum (ING)

– FII Summit: Inclusive ESG champions panel discussion

– ESG Investment Europe 2022, Reuters Events

The Investor Relations function is comprised of experienced professionals with a variety of backgrounds covering engineering, finance, banking, treasury, together with extensive business acumen. Most of the team is certified with CIRO certification (Certified Investor Relations Officer), including our listed affiliates, as well as, IFSAH certification.

The function is headed by the Investor Relations Officer who, in turn, is the Secretary of SABIC’s Board of Directors. In addition, since early 2020, we have a dedicated team within Investor Relations to address ESG communications and disclosures.

We provide a wide range of information online through our website and shareholders can reach the IR team directly by email at IR@SABIC.COM and by telephone+966112258000. In 2022, we established a dedicated Investor Relations Call Center to serve shareholder inquiries and increase shareholder satisfaction. Investors can now reach the Call Center through SABIC’s page in the Saudi Exchange.

We also post all relevant presentations of our quarterly calls in our website.

SABIC INVESTOR DAY

SABIC organized the first ever Investor Day to engage with the global investor community, a two-day hybrid event in Riyadh and Jubail. During the event, SABIC leaders presented our growth strategy and performance, and highlighted our carbon neutrality, circularity and sustainability initiatives.

Attendees were also provided access to some of the SABIC’s facilities around Riyadh, including the SABIC Global Headquarters, the SABIC Plastic Applications Development Center (SPADC) and SABIC’s Home of Innovation.

On the second day of the event, attendees had the opportunity to meet with the leaders of SABIC’s listed affiliates and visit SABIC’s Jubail operations, which included a tour to the Carbon Capture and Purification Unit in SABIC’s United plant. Built in 2015, it is the largest facility of its kind in the world.

Further information on the 2022 Investor Day is available online.

BEST-IN-CLASS DISCLOSURES

Our focus to continuously enhance our disclosures has been recognized by the Middle East Investor Relations Association (MEIRA) receiving a 3rd place of best 2021 Digital Integrated Report of Large Caps in the MENA region.

We have been issuing a dedicated Sustainability report since 2011. It has substantially been evolving over the years to include broader Environmental, Social and Governance (ESG) disclosures.

ESG disclosures have been embedded into the Earnings publications from the outset, acknowledging the need from investors to also understand the ESG performance and outlook.

SABIC DEBT CAPITAL MARKETS

Our net debt to EBITDA of (-0.36) reflects a strong net cash position at the end of the year of about SAR 13.92 bln.

The Investor Relations team and the Treasury team also maintained regular communication with the debt investor community and credit rating agencies.

We collaborated on the creation of the first fixed income guide from MEIRA for investor professionals “Guide for Best Practice Debt IR”, sharing SABIC’s best practices with debt investors.

OVERVIEW OF SABIC'S MAIN BONDS

| ISIN Code |

|

XS1890684688 | XS1890684761 | XS2228112954 | XS2228113762 |

|---|---|---|---|---|---|

| Coupon | 4% | 4.50% | 2.15% | 3% | |

| Issuer | SABIC Capital II BV | SABIC Capital II BV | SABIC Capital II BV | SABIC Capital II BV | |

| Format | 144A/RegS Senior Unsecured | 144A/RegS Senior Unsecured | RegS Senior Unsecured | RegS Senior Unsecured | |

| Volume | US$ 1 bln | US$ 1 bln | US$ 500 mln | US$ 500 mln | |

| Term | 2018/2023 | 2018/2028 | 2020/2030 | 2020/2050 | |

| Listing | Ireland | Ireland | Ireland | Ireland |

SABIC CREDIT RATINGS

Our standalone credit ratings have been consistently on the A+/A1 band, among the highest rated global chemical companies, demonstrating consistent resilience over the last decade versus some of our peers. Both Standard and Poors and FitchRatings revised SABIC’s outlook in April and May 2022 respectively.

SABIC – A SUSTAINABLE INVESTMENT

The SABIC share is attractive for investors focusing on companies with a strong ESG performance.

SABIC’s ESG efforts were recognized for two consecutive years when we received the Best ESG Award at the Saudi Capital Markets Forum.

Leading ESG rating agencies consider SABIC best in class on ESG within the chemical industry and the region. Their ratings particularly recognize SABIC’s strong corporate governance, and the comprehensive measures to address relevant sustainability issues.

We actively participate in a large number of ESG ratings, and is listed in several sustainability indices.

In June 2022 we became a constituent of the FTSE4Good index series.