Strategy

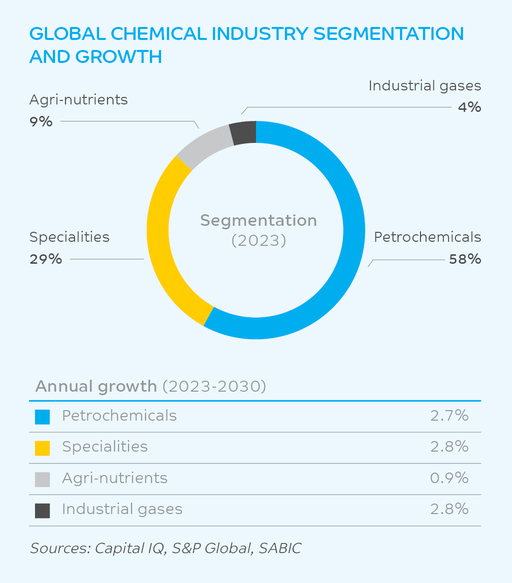

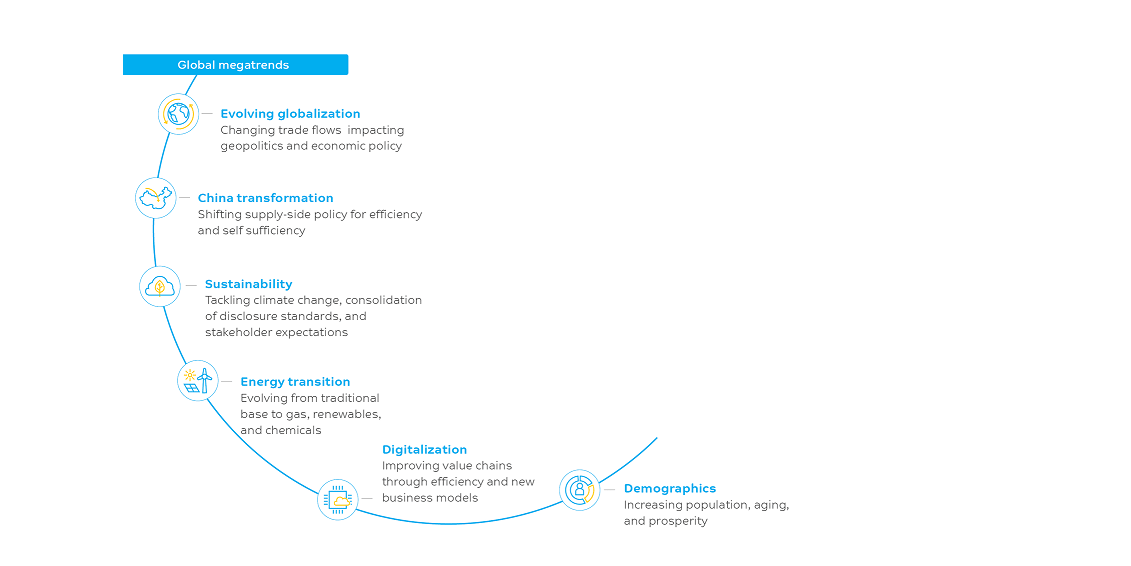

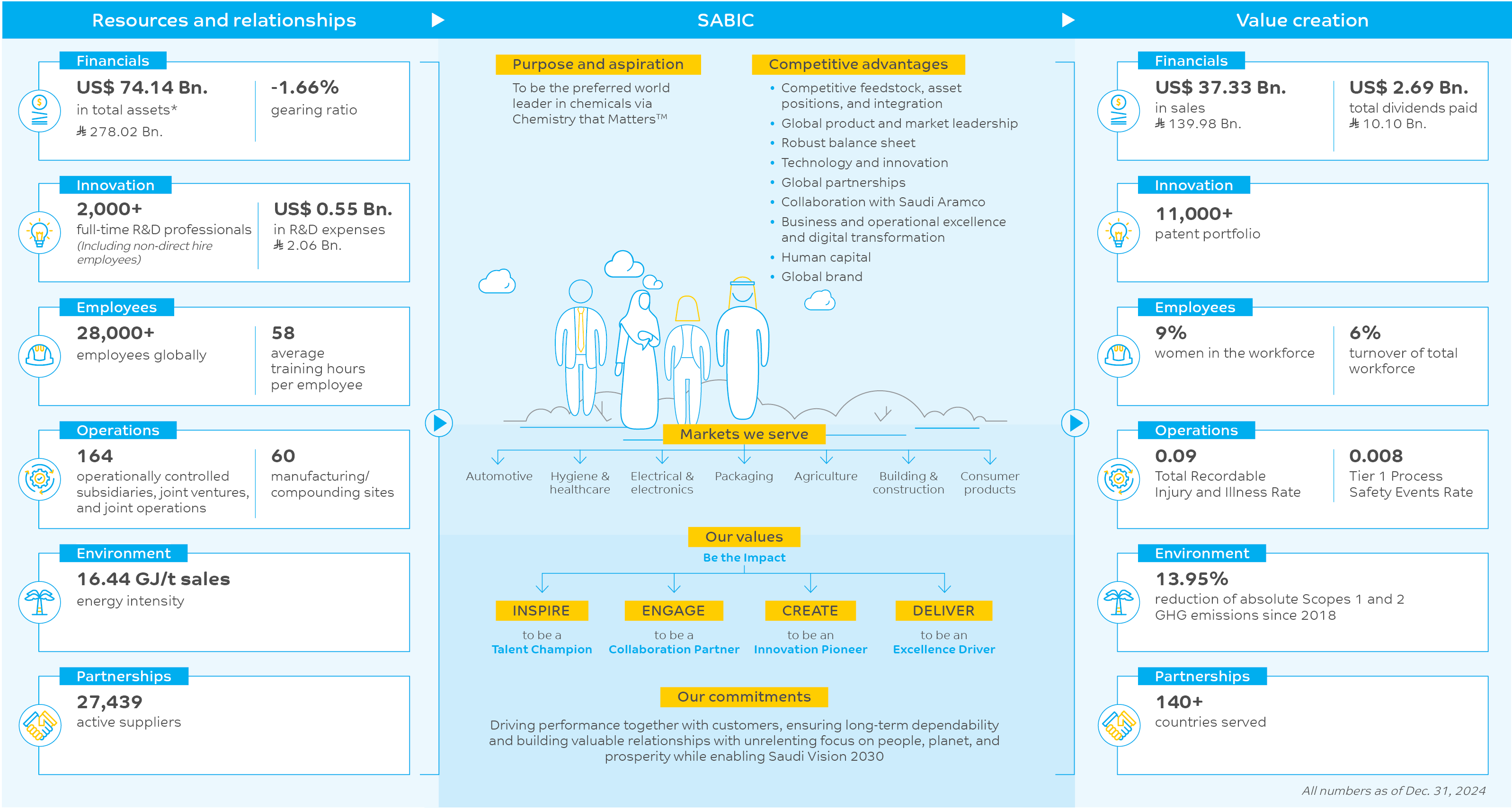

SABIC's strategy responds to transformative shifts in the chemical industry and aligns with the goals of Saudi Vision 2030.

SABIC BUSINESS MODEL

STRATEGIC LEVERS:

Our strategy is driven by four levers: transformation, portfolio management, growth, and value creation.

TRANSFORMATION

Transformation is the priority lever of our strategy. SABIC recognizes the need to transform to remain competitive and resilient. The first phase of this transformation, carried out from 2015 to 2023, has already delivered value. Building on this foundation, we launched a new transformation program in 2024 to address emerging challenges across both external and internal contexts. This program focuses on enhancing cost efficiency and functional excellence while addressing underperforming businesses, functions, and regions. It is supported by our ongoing digital transformation, which acts as a key enabler for driving efficiency. This SABIC-wide transformation program is sponsored by the CEO with the aim of developing detailed transformation initiatives and a bankable plan to capture, realize, and sustain the company's full potential, driven by structural capability enhancements. The program also integrates with and leverages other strategic efforts, including the SABIC-Saudi Aramco integration program and SABIC's benchmarking initiative, to ensure alignment and maximize impact.

PORTFOLIO MANAGEMENT

GROWTH

Our third strategic lever is growth. We aim to invest selectively in highly attractive projects aligned with our core portfolio and growth regions, leveraging regional competitive advantages such as feedstock, capital efficiency, and market access. To achieve this, we will create win-win partnerships with regional and global chemical companies. As the chemicals arm of Saudi Aramco, SABIC will also enable Saudi Aramco's downstream strategy through investments, sales and marketing, technology licensing, manufacturing support and servicing, and infrastructure sharing, creating value for shareholders.

VALUE CREATION

Disclaimer: This abridged interactive version of the SABIC Integrated Annual Report 2024 is based on the original PDF report published on this website. In case of any discrepancy, the original PDF report will prevail.