SABIC GOVERNANCE FRAMEWORK

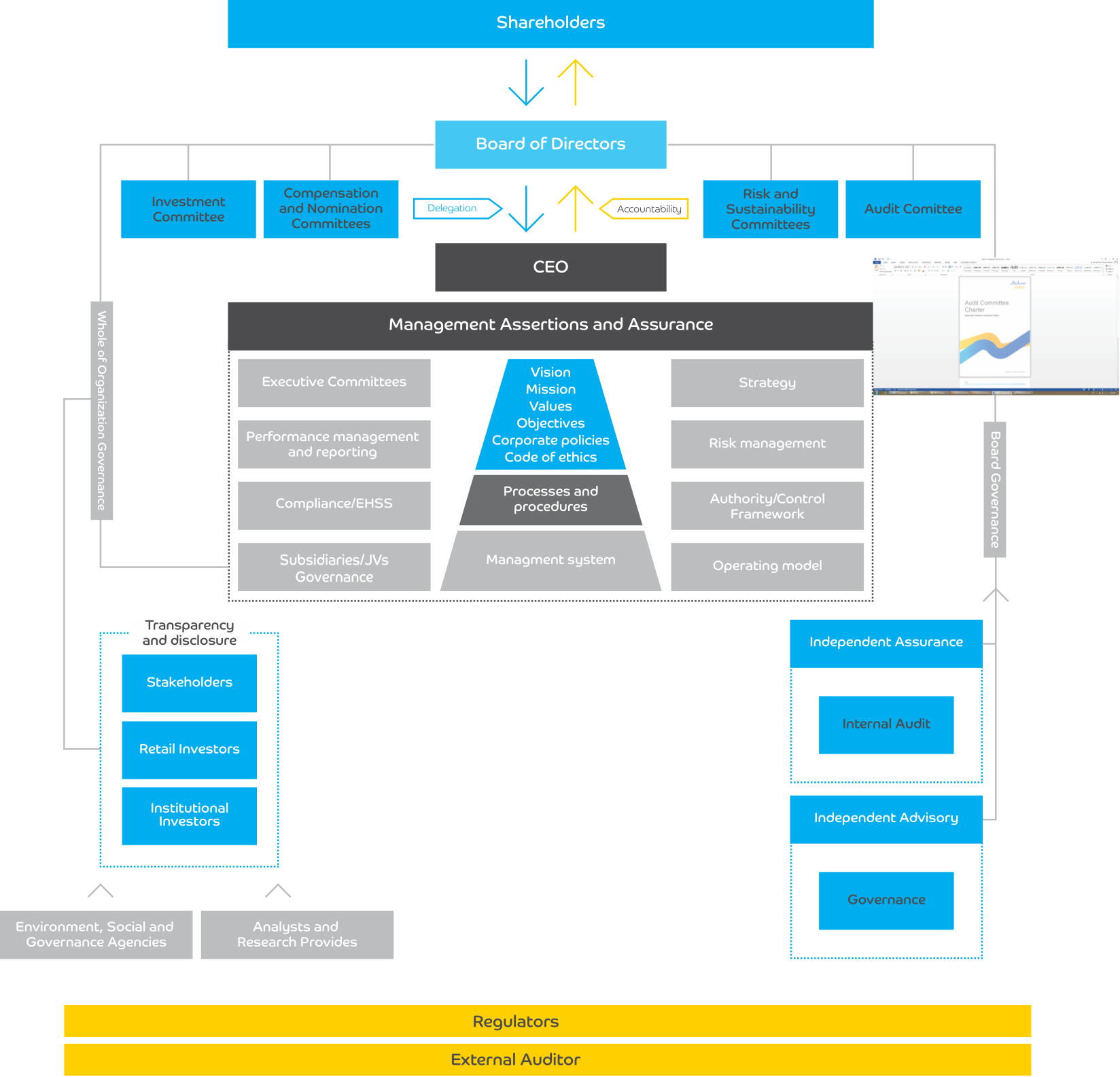

SABIC’s governance framework aligns each governance element to the organization’s purpose and objectives.

Corporate Governance Structure

CORPORATE GOVERNANCE STRUCTURE

SABIC is committed to the highest standards of corporate governance and applies all applicable provisions of the Corporate Governance Regulations issued by the CMA (subject to certain permitted derogations) as well as international governance principles and best practices, where applicable. SABIC has developed a corporate governance framework, which includes regulations and policies that promote transparency, accountability and competence.

SABIC’s management structure consists of a board of directors (the “Board”), four board committees and a team of executive officers (the “Executive Management”). The Board has overall responsibility for establishing, overseeing and reviewing SABIC’s governance principles and policies in order to ensure that SABIC is in compliance with relevant regulations while, at the same time, enhancing the growth and sustainability of SABIC.

The Board has formed three committees, in addition to the Audit Committee, which was formed by the general assembly, to assist it with the performance of its functions, namely, the Nomination and Remuneration Committee, the Risk and Sustainability Committee and the Investment Committee. The performance of these committees is subject to periodic review according to several factors, including the need of the relevant committee to continue supporting the Board. The Executive Management is responsible for the day-to-day management of SABIC’s operations.

Lastly, shareholders are among the most critical part of SABIC Governance Framework. The Board Charter requires that “the Board member must attend General Assembly Meetings”. By this mandate, the Board aims to meet with shareholders and receive their suggestions and observations about the company and its performance.

The company’s Articles of Association ensure shareholders’ participation in the deliberations and discussions at General Assembly Meetings. In addition, to enhance communication with shareholders, the Board has adopted Disclosure Policy and Procedures including processes to ensure that shareholders have the right to inquire and request information, and have queries answered, in a manner that does not harm the interests of the company.