OWNERSHIP STRUCTURE

SABIC was established by the Government of Saudi Arabia as a 100% state-owned company. SABIC’s shares were listed on the Saudi Stock Exchange in 1984, at which time the Government divested 30% of its shareholding in SABIC. As at 31 December 2019, SABIC had issued and paid up share capital of SAR 30,000,000,000 consisting of 3,000,000,000 shares of SAR10 par value per share. The following entity holds more than 5% of SABIC’s issued shares:

The remaining SABIC shares are owned by other investors, including certain institutions and private investors. Certain shares are also held by SABIC’s Board of Directors and Senior Executives. Other than the Government, SABIC is not aware of any shareholder that, directly or indirectly, owns or could exercise control over SABIC. In addition. SABIC has not been informed by persons (other than the Board, Senior Executives and their relatives) who own SABIC shares, for their holdings, together with any change to such interests during the last fiscal year.

On March 27, 2019, the Public Investment Fund (PIF) and Saudi Aramco signed a share purchase agreement, pursuant to which Saudi Aramco has agreed to acquire all of PIF’s stake in SABIC. Completion of the transaction is subject to customary closing conditions, including regulatory approvals. Upon completion of the transaction, Saudi Aramco will own 70% of SABIC’s outstanding share capital.

| Name |

|

No. of shares | Percentage of ownership |

|---|---|---|---|

| Public Investment Fund - wholly-owned by the Government | 2,100,000,000 | 70% |

DESCRIPTION OF DIVIDEND POLICY

Dividend is subject to realized net income and free cash flow during the year and according to Article (41) of the Company Bylaw, which reads as follows:

1. Annually, the Corporation shall set aside ten percent (10%) of the net profits to form the statutory reserve. The Ordinary General Meeting may decide to stop this deduction whenever the said reserve amounts to thirty percent (30%) of the capital of the Corporation. If in any year, the reserve falls below thirty percent (30%) of the capital, the Corporation shall again set aside until the reserve amounts to thirty percent (30%) of the capital. The Ordinary General Meeting has the authority to decide other kinds of reserves.

2. After deducting the statutory reserve and any other reserve that may be decided by the Ordinary General Meeting, five percent (5%) of the paid-up capital shall be distributed from the annual net profits of the Corporation, to the shareholders as initial dividend.

3. With due regard to the provisions of the Companies Law, the required amount shall be allocated for the Board members’ remunerations approved by the Ordinary General Meeting in compliance with Article (15) of this Bylaws provided that entitlement for such remuneration shall be proportional to the number of sessions attended by the member and the member’s jurisdictions and responsibilities. Thereafter, the balance shall then be distributed to the shareholders as an additional dividend or carried over to the subsequent years.

Note that the Board of Directors had approved 1st half dividend and recommended 2nd half to the General Assembly to distribute dividends for 2019 as follows:

| Dividends cycle |

|

Dividend per share | Percentage of distribution to share nominal value | No. of shares | Total distributed dividends | Date of eligibility | Date of eligibility |

|---|---|---|---|---|---|---|---|

| Second half of 2018 | SAR 2.2 | 22% | 3 billion | SAR 6.6 billion | 9th April 2019 | 30th April 2019 | |

| First half of 2019 | SAR 2.2 | 22% | 3 billion | SAR 6.6 billion | 16th September 2019 | 30th September 2019 | |

| Second half of 2019 | SAR 2.2 | 22% | 3 billion | SAR 6.6 billion | The end of the second trading day of the day of the General Assembly of the company, which will be announced later. | Will be announced at the AGM invitation. |

Dividend per Share for the last eleven years (SAR)

ENGAGEMENT WITH CAPITAL MARKETS

We aim to have a world-class engagement with all participants of Capital Markets. Our approach is to build sustainable relationships with all Capital Markets participants to communicate the SABIC investment story, growth strategy and how SABIC will build value over time. We aim to implement our approach structurally and consistently.

Saudi Arabia was reclassified from Frontier Market to Emerging Market by several financial market indices starting mid 2018. Since then, international investors have shown increased interest in SABIC. Along with the reclassification, over the last two years we have increased our investor engagement substantially. We engaged with more than 300 participants in the Capital Markets, including institutional investors and sell side analysts, 50% more than the previous year, through numerous one-on-one meetings non-deal roadshows and conferences worldwide.

Foreign ownership represented less than 0.5% of the total shareholding at the beginning of 2019. The year closed with 4.5%, with a mix of passive, active and sovereign wealth funds as new investors.

Our increased engagement has been recognized with the “Best Investor Relations Program in Chemicals” covering the emerging EMEA region. This recognition is based on a global survey conducted every year during March and April by Institutional Investor.

Earlier in the year, Investor Relations received two more nominations: Most improved Investor Relations team in MENA region – Bluechip (above USD10bn); and Leading Corporate for Investor Relations – Saudi Arabia, certifying that we are walking in the right direction.

As we head into 2020, we are working hard to introduce regular quarterly investor earning calls, increase business leaders’ exposure with investors, integrate our strong Environment, Social and Governance (ESG) story into the investment story and many more engagements.

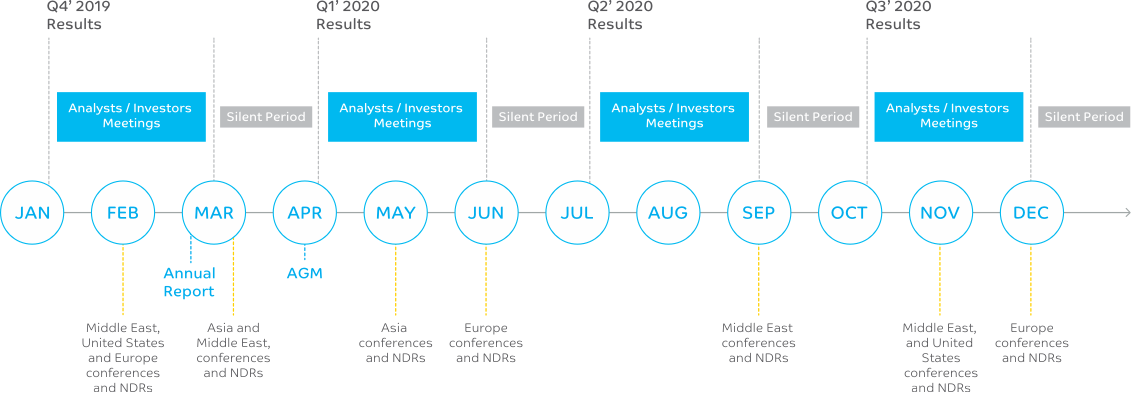

Below is our Investor Relation Calendar for 2020.

Investor Relation Calendar - 2020

NUMBER OF THE COMPANY’S APPLICATIONS FOR THE REGISTER OF SHAREHOLDERS AND THE DATES AND RATIONAL OF SUCH APPLICATIONS

| No. |

|

Application date | Application rational |

|---|---|---|---|

| 1 | 14 January 2019 | Shareholder Analysis | |

| 2 | 08 April 2019 | Shareholder Analysis | |

| 3 | 08 April 2019 | Annual General Meeting | |

| 4 | 14 April 2019 | Dividend Entitlement | |

| 5 | 30 May 2019 | Shareholder Analysis | |

| 6 | 01 July 2019 | Shareholder Analysis | |

| 7 | 08 August 2019 | Shareholder Analysis | |

| 8 | 18 September 2019 | Dividend Entitlement | |

| 9 | 06 November 2019 | Shareholder Analysis | |

| 10 | 03 December 2019 | Shareholder Analysis | |

| 11 | 30 December 2019 | Shareholder Analysis | |

| 12 | 30 December 2019 | Shareholder Analysis |